Regarding health insurance plans, one of the most important things for your customers to understand is the difference between high and low deductibles. Understanding this difference between high and low deductibles can help your clients make an informed decision when selecting a health insurance plan. Here are 8 things for your customers to consider when comparing high vs low deductibles:

Cost:

High deductibles generally mean lower monthly premiums, while low deductibles typically mean higher monthly premiums. Depending on your budget and healthcare needs, customers need to weigh the pros and cons of higher and lower deductibles to determine what’s best for their situation.

Coverage:

High deductible plans tend to have higher out-of-pocket costs and fewer covered services, while low deductible plans may have more comprehensive coverage but with higher monthly premiums.

Maximum out-of-pocket expenses:

High deductible plans tend to have higher maximum out-of-pocket expenses, while low deductible plans tend to have lower maximum out-of-pocket expenses. This is an essential factor for clients to consider when selecting a plan.

Tax benefits:

Some high-deductible plans are eligible for tax benefits. Depending on the situation, these tax benefits could make a high-deductible plan more attractive to customers than a low-deductible plan.

What services are covered:

Be sure to look closely at what services are covered under a high-deductible plan vs a low-deductible plan. Make sure you understand how the plan works and what services are covered before enrolling.

Copayments and coinsurance:

Copayments and coinsurance vary among plans and can affect how much clients pay out-of-pocket. In a high deductible plan, customers may pay more out-of-pocket than in a low deductible plan.

Network coverage:

Network coverage is important to consider when selecting a plan. High deductible plans may have more limited network coverage, so make sure your customers look closely at the provider networks available under each plan.

Prescription drug coverage:

Many high-deductible plans have limited prescription drug coverage and may require clients to pay more out-of-pocket for their medications. Make sure to remind clients to look closely at prescription drug coverage before enrolling in a plan

When selecting a health insurance plan, it is crucial for shoppers to understand the differences between high and low deductibles. Remind your customers that high-deductible plans can be more cost-effective but may have higher out-of-pocket expenses and more limited coverage. Meanwhile, shoppers should remember that low deductible plans often have higher premiums but more comprehensive coverage. Understanding the benefits and limitations of each option can help consumers make an informed decision that best fits their healthcare needs and budgets.

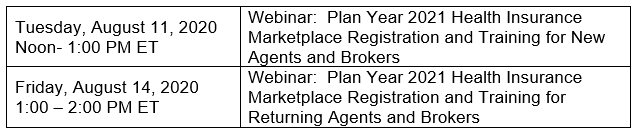

Access our agent training webinars and live events here!

Agility Producer Support

(866) 590-9771

support@enrollinsurance.com

.png)