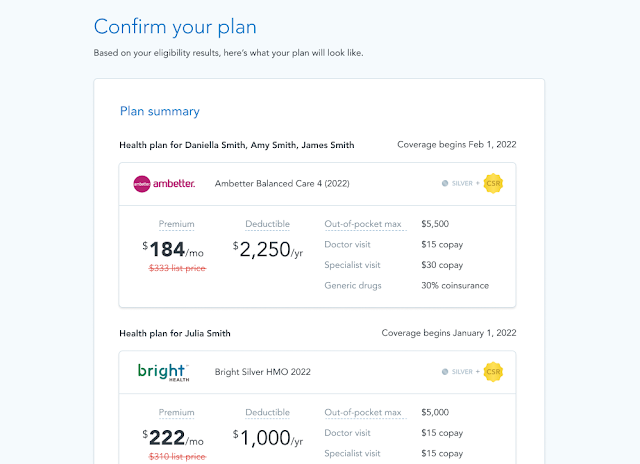

President Biden announced that the Centers for Medicare & Medicaid

Services (CMS) is extending access to the Special Enrollment Period

(SEP) until August 15 – giving consumers additional time to take

advantage of new savings through the American Rescue

Plan.

This action provides new and current enrollees an additional

three months to enroll or re-evaluate their coverage needs with

increased tax credits available to reduce premiums.

“Every American deserves access to quality, affordable health care –

especially as we fight back against the COVID-19 pandemic,” said HHS

Secretary Xavier Becerra. “Through this Special Enrollment Period, the

Biden Administration is giving the American people

the chance they need to find an affordable health care plan that works

for them. The American Rescue Plan will bring costs down for millions of

Americans, and I encourage consumers to visit HealthCare.gov and sign

up for a plan before August 15.”

As a result of the American Rescue Plan, additional savings will be

available for consumers through HealthCare.gov starting April 1. These

savings will decrease premiums for many, on average, by $50 per person

per month and $85 per policy per month. On average,

one out of four enrollees on HeathCare.gov will be able to upgrade to a

higher plan category that offers better out of pocket costs at the same

or lower premium compared to what they’re paying today.

Consumers who want to access the SEP to enroll in coverage and see if

they qualify for financial help to reduce the cost of monthly premiums,

can visit

HealthCare.gov or

CuidadoDeSalud.gov to view 2021 plans and prices and enroll in a plan that best meets their needs. Additionally, consumers can call the

Marketplace Call Center at 1-800-318-2596, which provides assistance

in over 150 languages. TTY users should call 1-855-889-4325. Consumers

can also find a local assister or agent/broker in their area:

https://localhelp.healthcare.gov

Consumers who are eligible and enroll under the SEP will be able to

select a plan with coverage that could start as soon as the first month

after plan selection. Current enrollees will be able to change to any

plan available to them in their area. To take

advantage of the SEP, current enrollees should review their application

and make changes, if needed, to their current information and submit

their application in order to receive an updated eligibility result.

Additionally, beginning in early July on HealthCare.gov, consumers

who have received or have been determined eligible to receive

unemployment compensation for any week during 2021 may be able to get

another increase in savings when enrolling in new Marketplace

coverage or updating their existing Marketplace application and

enrollment. These savings to be made available starting in early July

for eligible consumers are in addition to the increased savings

available to consumers on HealthCare.gov starting April 1.

The SEP is currently available to consumers in the 36 states that use the

HealthCare.gov platform. Consumers served by State-based

Marketplaces that use their own platform can check their state’s website

to find out more information on Special Enrollment Periods in their

state.

To see how the American Rescue Plan will bring down health care costs and expand on the Affordable Care Act, visit:

https://www.hhs.gov/about/news/2021/03/12/fact-sheet-american-rescue-plan-reduces-health-care-costs-expands-access-insurance-coverage.html.

Still looking to get contracted with top carriers to expand your book of business? Get ACA Contracting Here.

Agility Producer Support

(866) 590-9771

support@enrollinsurance.com

.png)