CVS-Aetna Branded Obamacare Plans Target 8 States For 2022 Launch

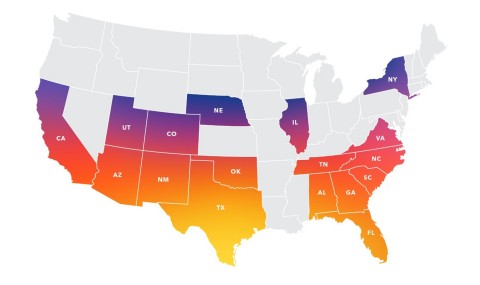

CVS Health is looking to sell individual coverage with the “CVS-Aetna” brand on exchanges under the Affordable Care Act in up to eight states for 2022.

Citing better market conditions and quality low priced health plans it can offer. CVS Health’s Aetna health insurance unit left the ACA’s exchanges four years ago under prior Aetna management along with other insurers that were unable to manage rising costs of uninsured patients signing up for such coverage.

CVS explained the company is just now working with insurance regulators and submitting plans and rates to offer individual coverage under the ACA, which is also known as Obamacare after President Obama. CVS isn’t yet disclosing the states it plans to offer these plans, executives confirmed Tuesday.

The CVS-Aetna move back into the ACA individual business comes under a more supportive White House under President Joe Biden, who was Obama’s vice president when the ACA became law.

Health insurers are already seeing a spike of new individual Obamacare subscribers thanks to new regulations and support to the companies and Americans looking for coverage from the Biden administration. That contrasts with the Donald Trump administration, which attempted to get Congress to repeal the ACA.

CVS sees a large market of Americans that have no coverage and the opportunity to offer a unique product given the company’s network of pharmacies, MinuteClinics, and hundreds of HealthHub store formats.

Here’s what the law means for you:

- Almost everyone is required to have health insurance.

- Nobody can be denied health insurance coverage.

- Most health plans must include preventative care at no cost to you.

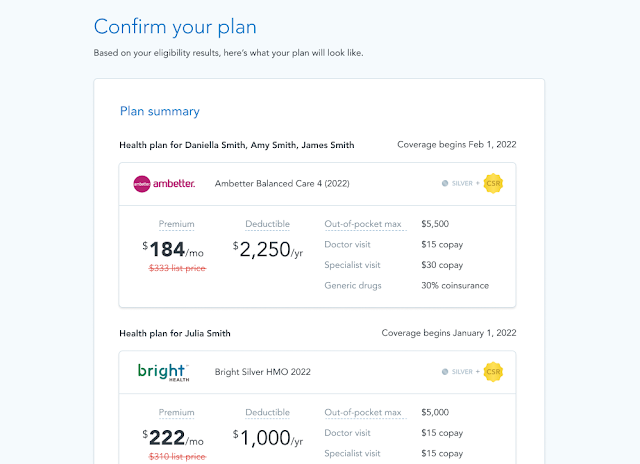

- For most health plans, your out-of-pocket costs for healthcare can’t exceed a set amount.

- You must get a clearly written summary of your benefits and coverage.

- Children can stay on the family health plan until they turn 26.

- You can buy a health plan through a public exchange, or marketplace. Or you can buy a health plan without going through the public exchange. These plans must cover a defined set of benefits.

- If you buy your plan through a public exchange, the government may help you pay for it.

The law covers most health plans sold today, but some parts don’t apply to plans that were sold before the law was passed.

Agility Producer Support

(866) 590-9771

support@enrollinsurance.com